There are no items in your cart

Add More

Add More

| Item Details | Price | ||

|---|---|---|---|

Fri Jul 18, 2025

Tata Communications found itself in the investor spotlight today after revealing its Q1 FY26 financial performance - and the numbers tell a concerning story. While the company managed 7% year-on-year revenue growth, its net profit crashed by a staggering 43%, leaving stakeholders scratching their heads. 🤔

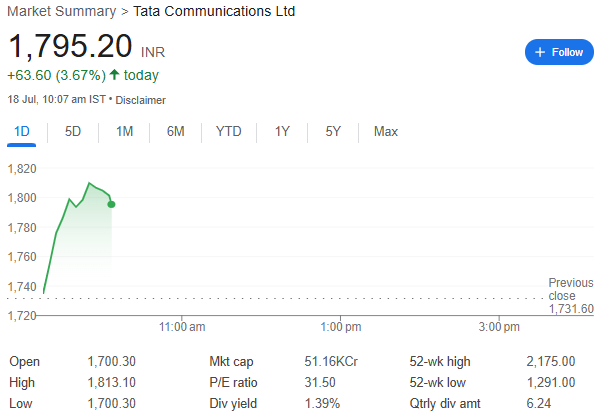

Here's what happened when markets closed on Thursday:

Let's look at how different business segments performed:

Operating expenses tell part of the story:

While the revenue growth shows the company can still attract business, the profit crash raises red flags about:

Investors will be watching closely to see if this is a temporary setback or the start of a troubling trend. With shares holding relatively steady post-announcement, the market seems to be giving Tata Communications the benefit of the doubt - for now. ⏳

Key questions going forward:

One thing's certain - the next quarter's results will be even more scrutinized after this performance. Stay tuned! 👀

⚠️ Disclaimer: This article is for Educational purposes only and should not be considered as investment advice. 📈 Always consult a trusted advisor from MBC Trading Platform before making any investment decisions.

👥 Team MBC

📍 Expert Stock Market Analysts & Trainers serving Rajamahendravaram, Visakhapatnam, and Vijayawada.

💼 Excellence in Market Insights & Training Solutions.

MBC Trading Platform

Monday – Saturday: 9 AM – 7 PM

🏢 Royal Enfield showroom, 26-16-5,

Nandamgani Raju Junction, near Anand Regency, Kambala Cheruvu,

Rajamahendravaram, Andhra Pradesh 533101, India

Read our previous blogs:

Stay updated with the latest stock market insights, news, and updates only on MBC Trading Platform – your trusted destination for stock market offline and online classes!