There are no items in your cart

Add More

Add More

| Item Details | Price | ||

|---|---|---|---|

Thu Aug 14, 2025

IRCTC has once again captured investors' imagination this quarter, delivering a performance that shows why it remains a darling of the railway sector. The Indian Railway Catering and Tourism Corporation posted numbers that tell a story of resilience and strategic growth.

The first quarter results reveal why analysts are buzzing about this railway PSU stock:

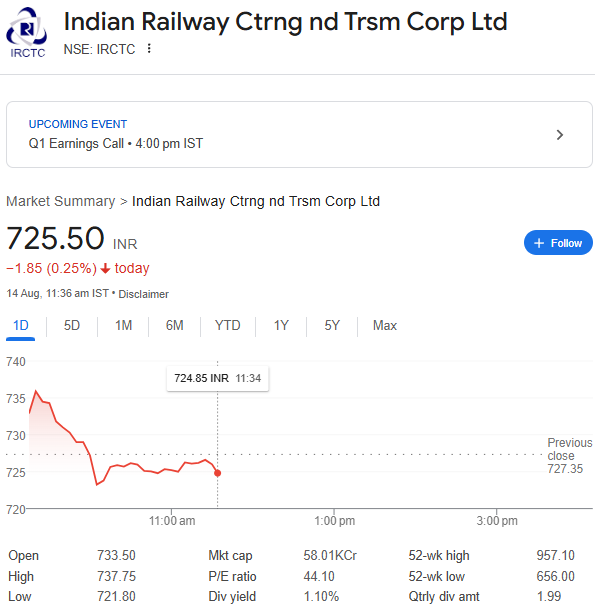

The market responded positively, with IRCTC shares closing at ₹727.55 on the BSE - a modest but meaningful gain for investors who've stayed the course.

In a significant corporate development, IRCTC has decided to wind up its joint venture Royale Indian Rail Tours Limited (RIRTL) with Cox & Kings. This cleanup of non-performing assets shows management's focus on core competencies.

However, it's not all smooth sailing. The company faces some regulatory headwinds:

Despite the challenges, the IRCTC Board remains bullish about the company's future. And why shouldn't they be? With:

IRCTC's Q1 performance shows the company's fundamental strength in India's railway ecosystem. While legal and regulatory issues need monitoring, the 11.8% revenue growth and margin expansion tell a compelling story.

For long-term investors, IRCTC stock continues to offer exposure to India's growing rail travel market with multiple growth levers. The current challenges appear manageable for this railway PSU with strong cash flows and market position.

⚠️ Disclaimer: This article is for Educational purposes only and should not be considered as investment advice. 📈 Always consult a trusted advisor from MBC Trading Platform before making any investment decisions.

👥 Team MBC

📍 Expert Stock Market Analysts & Trainers serving Rajamahendravaram, Visakhapatnam, and Vijayawada.

💼 Excellence in Market Insights & Training Solutions.

MBC Trading Platform

Monday – Saturday: 9 AM – 7 PM

🏢 Royal Enfield showroom, 26-16-5,

Nandamgani Raju Junction, near Anand Regency, Kambala Cheruvu,

Rajamahendravaram, Andhra Pradesh 533101, India

Read our previous blogs:

Stay updated with the latest stock market insights, news, and updates only on MBC Trading Platform – your trusted destination for stock market offline and online classes!