Investors are holding their breath as India's IT giants—Infosys, Wipro, Tech Mahindra (TechM), and HCL Technologies—come under scrutiny following Tata Consultancy Services' (TCS) weaker-than-expected Q1 results. With the sector already facing headwinds this year, TCS's performance has added fuel to the fire of uncertainty. 🔥

📉 TCS's Missed Expectations: A Warning Sign for the Sector?

The numbers tell a concerning story:

- Revenue fell 3.3% sequentially (constant currency) vs. expected 1.4% drop

- EBIT margin held at 24.5% (met expectations)

- International revenue dipped 0.5% QoQ → Global demand concerns

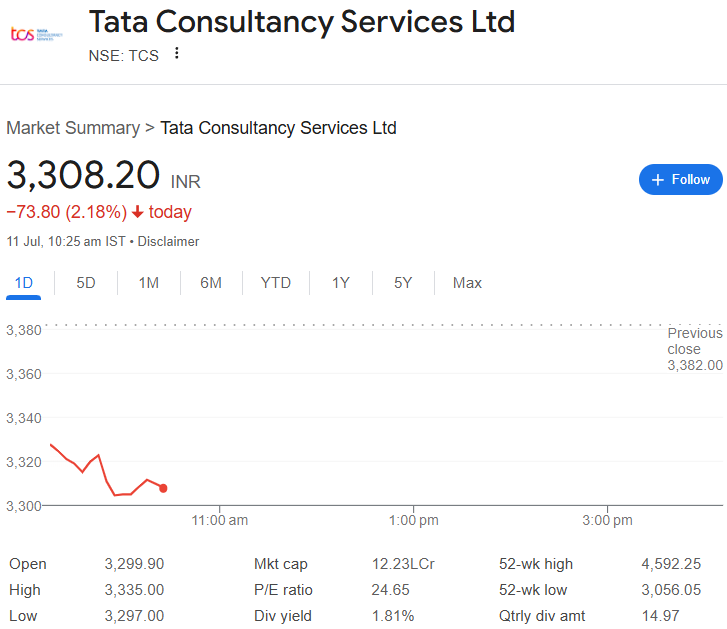

The market reaction was swift and brutal:

💼 A Brutal Year for IT Stocks

2025 has been particularly unkind to tech:

- 📊 BSE IT Index down 13% (vs. Sensex +6%)

- 🏆 Biggest losers:

- TCS (-18%) 😬

- Infosys

- HCL Tech

- TechM

🔍 Spotlight Shifts to Infosys: Can It Save the Day?

All eyes now turn to Infosys' upcoming results. Analysts predict:

- 1.7% revenue growth (QoQ)

- Potential boost from seasonal factors and weak Q4 base

But the million-dollar question: Will Infosys beat expectations, or confirm sector-wide troubles? 🤔

💡 Silver Linings? Deal Wins vs. Spending Cuts

It's not all doom and gloom:

- ✅ TCS secured $9.4 billion in deals (met expectations)

- But... key sectors are tightening belts:

- 🏦 BFSI

- 🛍️ Retail

- 💻 Hi-Tech

"The demand environment remains subdued," warns Nirmal Bang Institutional Equities, noting weak discretionary spending across the board.

🤔 What Should Investors Do Now?

The big debate:

- Short-term pain: High interest rates + weak global demand = continued pressure

- Recovery hope: Stable numbers from Infosys/Wipro could boost sentiment

For now, caution is king as the market waits with bated breath for the next round of earnings. 👑

🎯 Conclusion:

This isn't just about one bad quarter—it's about whether India's $245 billion IT sector is facing a temporary setback or a fundamental shift. With digital transformation still driving global business, the long-term story remains intact... but investors might need to weather some storms first. ⛈️➡️🌈

Your move: Will you see this as a buying opportunity or wait for clearer skies? Let us know in the comments! 💬

Launch your Graphy

Launch your Graphy