Honasa Consumer Ltd (parent company of popular brands like Mamaearth) saw its shares soar nearly 14% on Wednesday after announcing its Q1 FY26 results. This dramatic surge has everyone talking - from day traders to long-term investors - all wondering: "Is this the real deal or just a flash in the pan?" 🤔

💰 Stock Performance: A Rollercoaster Ride

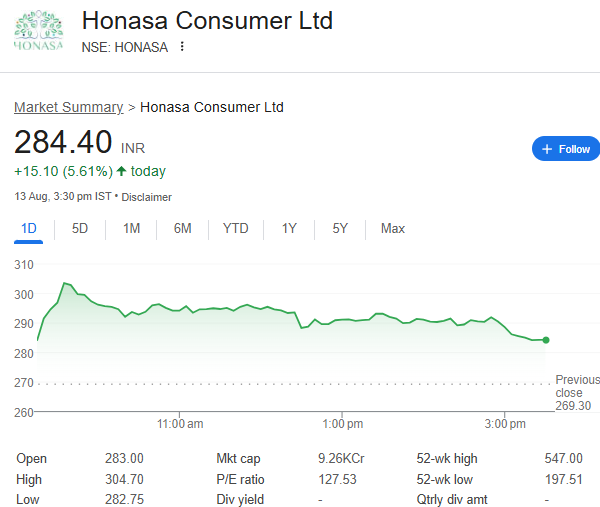

During Wednesday's wild trading session, Honasa shares shot up 13.68%, hitting ₹304.80 at one point - pushing its market cap tantalizingly close to ₹9,500 crore. That's quite the comeback from Tuesday's closing price of ₹268.10!

But here's the catch: despite this impressive single-day rally, the stock is still trading nearly 50% below its 52-week high of ₹546.50 (September 2024). This stark reality is keeping many investors awake at night, nervously sipping their chai while staring at their portfolios. ☕

📊 Q1 Results Breakdown (June 2025 Quarter)

- Net Profit: ₹41 crore (2.7% YoY growth) - Not earth-shattering, but moving in the right direction ↗️

- Revenue: ₹595 crore (7% YoY growth) - Steady as she goes with their product portfolio 🛍️

- EBITDA: ₹46 crore (flat YoY) - Could be better, could be worse 🤷♂️

- Margins: Slipped to 7.7% - Clearly feeling the pinch of rising costs 💸

🔮 Market Outlook: What's a Smart Investor to Do?

For the quick-fingered traders 🎯: This rally might be your golden ticket to book some profits, especially after such a sharp single-day jump. Remember - pigs get fat, hogs get slaughtered!

For the patient investors 🌱: Keep your eyes on the bigger picture - the company's growth game plan, how their brands are positioning themselves, and most importantly, whether they can fatten those margins in the coming quarters.

🎯 Conclusion:

While Honasa Consumer's 14% stock price jump shows investors are excited again after the Q1 results, let's be real - climbing back to its 52-week high is like trekking up Everest without oxygen. �⛰️

At the end of the day (or trading session), your move should depend on: your risk appetite (how well you sleep at night), your investment horizon (patience level), and your belief in Honasa's long-term story.

So... buy, sell, or hold? The ball's in your court now! 🎾

Launch your Graphy

Launch your Graphy