💥 The Block Deal That's Shaking Markets

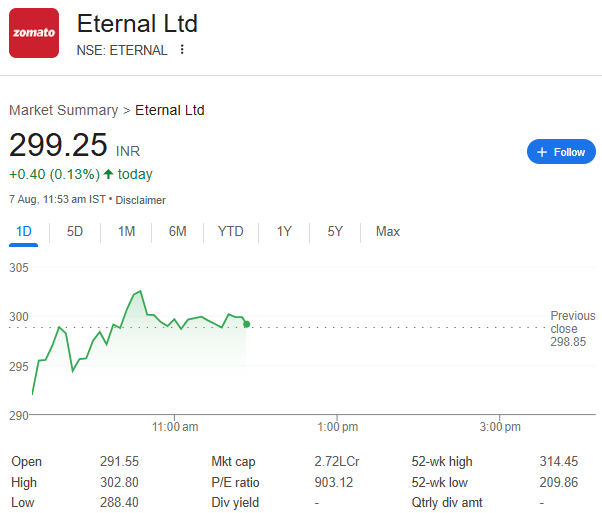

Mark your calendars - August 7th could be a wild ride for Eternal Ltd stocks. The parent company of household names like Zomato and Blinkit is about to see a massive ₹5,375 crore transaction as Alibaba-backed Antfin Singapore Holdings makes its complete exit.

Here's what's happening in simple terms:

- 🔹 18.85 crore shares hitting the market

- 🔹 Priced at ₹285/share (that's 4.6% cheaper than current rates)

- 🔹 Antfin's full 2% stake being offloaded

🤔 Why Is Antfin Walking Away?

This feels like déjà vu for investors. Just weeks after their painful Paytm exit (where they lost nearly $2 billion), Antfin is cutting ties with another Indian unicorn. What's really going on here?

Market whispers suggest:

- 🌍 Chinese investors are pulling back from Indian tech

- 📉 Concerns about profitability timelines in quick commerce

- 💸 Needing cash elsewhere after their Paytm disaster

📊 Eternal's Financial Health Check: The Good, Bad & Ugly

Let's peel back the quarterly numbers (Q1FY26) to understand the real story:

👍 The Wins:

- 🚀 70% revenue jump to ₹7,167 crore

- 🛒 Blinkit's growth is firing on all cylinders

- 🍔 Food delivery margins up 5%

👎 The Worries:

- 😱 90% profit nosedive to just ₹25 crore

- 📈 Operating costs up 15% (thanks, inflation!)

- ⚖️ The eternal struggle: growth vs profitability

🔮 Crystal Ball Time: What's Next for Eternal?

As retail investors, here's what we should watch for:

Short-Term (Next 3-6 Months):

- 📉 Possible stock price pressure from the block deal

- 👀 How other big investors react to Antfin's exit

Long-Term (1+ Years):

- 🛒 Can Blinkit become profitable before cash runs low?

- 🍽️ Will food delivery margins keep improving?

- 🌪️ How they handle rising competition (Swiggy, Zepto, etc.)

💡 The Conclusion for Investors Like You

This isn't just about Antfin - it's about your investment strategy. Here's how to think about it:

If you're risk-tolerant and believe in:

- 🇮🇳 India's quick commerce revolution

- 💪 Eternal's ability to outlast competitors

- ⏳ Waiting 3-5 years for returns

...this dip might be your chance. But if you prefer stable, profitable companies, this rollercoaster isn't for you.

My personal take? I'm watching how the stock reacts this week before making moves. The fundamentals show promise, but the path to profits remains foggy.

Launch your Graphy

Launch your Graphy